Describe the Relationship Between Bond Prices and Interest Rates

When interest rates go up bond prices drop and vice versa. Example of Bond Price Movements.

With the current climate around the economy and market many people are becoming interested in bond prices and interest rates and how the two are connected.

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

. When the cost of borrowing money rises when interest rates rise bond prices usually fall. Also explain the relationship between market interest rates and bond prices. Why do corporate bonds change when interest rates change.

Describe the differences between a coupon bond and a zero coupon bond. When interest rates are rising bond prices are falling and vice versa. Solution for What is the relationship between bond prices and interest rates.

They have an inverse relationship meaning as bond prices decrease interest rates increase and the reverse for each. There is an inverse relationship between price and yield. Who are the experts.

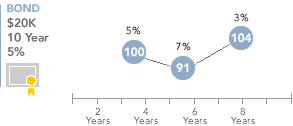

When a bond is issued it is given a coupon rate of interest that stays the same throughout the life of the. Calculate the price of the bond in euros if the yield to maturity is 35 percent. The easiest way to.

4 Bonds and interest rates. An inverse relationship exists between the prices of bond and interest rates. Any factors that bring about a rise in interest rates tend to cause a reduction in the bond price and therefore the market value of bond portfolios of these financial.

However the price and yield of T-bonds vary based on the issue. Posted 2 years ago. When interest rates rise bond prices fall and vice versa.

There is an unlikely relationship between interest rates and bond prices. When interest rates increase the value of a bond decreases. Bond prices and interest rates have an inverse relationship.

Bond prices are quoted in percentage terms so this is expressed as 100 or at par. Describe the relationship between bond prices and interest rates. Describe how this link came to be developed in detail.

During times of economic recession interest rates in general decline increasing bond prices. A government bond issued in Germany has a coupon rate of 5 percent a face value of 100 euros and matures in five years. Interest rates have been at historic lows since the 2008 financial crisis.

Similarly if there is a fall in the interest rates the bond prices will increase. Describe the process of establishing this link in detail. The bond prices and interest rates use to have inverse relationship or they move in opposite direction.

Describe the relationship between bond prices and interest rates. Its important to understand that bonds and interest rates have an inverse relationship meaning that when interest rates go up existing bond prices go down and when interest rates are low bond. Bond yields go up when interest rates go up.

Describe the relationship between bond prices and interest rates during a recession. Rising interest rates are a negative for bonds. The relationship between bonds and interest rate Bonds have an inverse relationship with interest rates.

So when you buy a bond you commit to receiving a fixed rate of return ROR for a set period. In other words a. You must be wondering how does this happen.

Briefly describe the price performance or price changes of the following bonds in the specified. Describe the relationship between interest rates and bond prices. To understand the reason behind this relationship lets consider an example.

Economic conditions and crisis situations cause interest rates to fluctuate. In the event of a terrorist. What approach may we use to determine the bonds value based on this relationship.

If the interest rate increases the price of bond will decrease and in the interest rate decrease the price of bond will increase. See answer 1 Best Answer. Use references to support your responses as needed.

Be sure to cite all references using correct APA style. We review their content and use your feedback to keep the quality high. Bonds are usually issued in denominations of 1000 known as the par.

Similarly when interest rates decrease the value of a bond increases. The market value of these bond investments is subject to changes in numerous factors such as changes in interest rates or credit ratings that may influence the bond prices. For instance if a bond has a par value of 1000 and is currently trading at 950 then the rate of return on the bond is around 5.

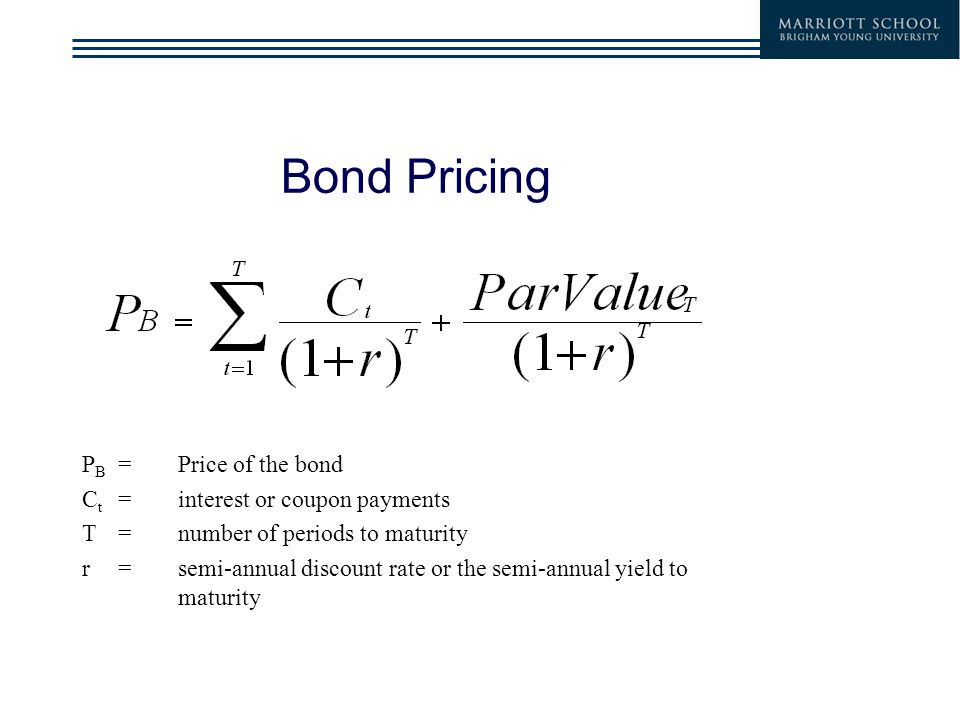

This means that when the interest rates rise the bond prices tend to come down. Open an Account Today. A bonds yield is the discount rate that can be used to make the present value of all of the bonds cash flows equal to its price.

Essentially bonds and interest rates have an inverse relationship. Interest rates have an inverse relationship with bond prices. Provide examples of each.

Bonds have an inverse relationship to interest rates. They have opposite moving relationships. An inverse relationship All else being equivalent if new securities are given with a higher loan cost than those presently available the cost of existing bonds will decay as interest for those bonds falls.

What is the relationship between bond prices and interest rates. How can we utilize this. To explain this lets use an example.

The bond pays annual interest payments. As interest rates go up the bond prices come down. When bond yields go up bond prices go down.

Empirically there is an inverse relationship between the RBIs interest rates and bond prices. With a 202 annualized rate of inflation the bonds are set to provide a minor return to investors over and above inflation. Define a discount bond and a premium bond.

Relationship Between Interest Rate Bond Prices Coupons. Similarly if View the full answer. Ad Put Your Investment Plans Into Action With Personalized Tools.

Experts are tested by Chegg as specialists in their subject area. This problem has been solved.

Coupon Rate Vs Interest Rate Top 8 Best Differences With Infographics

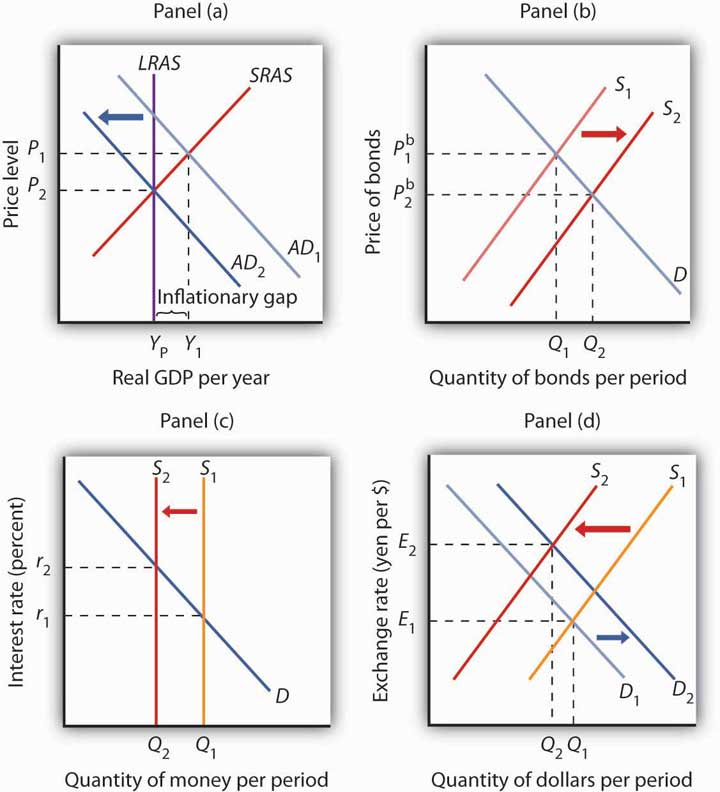

The Effects Of Inflation On The Supply And Demand Curve For Bonds The Motley Fool

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

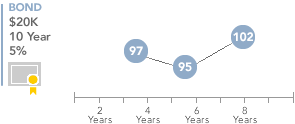

Duration And Convexity To Measure Bond Risk

Understanding Bond Duration Education Blackrock

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

How Are Bond Yields Affected By Monetary Policy

The Effects Of Inflation On The Supply And Demand Curve For Bonds The Motley Fool

Yield Curve Economics Britannica

Bond Prices Rates And Yields Fidelity

Yield Curve Economics Britannica

Bond Prices Rates And Yields Fidelity

Bond Pricing P B Price Of The Bond C T Interest Or Coupon Payments T Number Of Periods To Maturity R Semi Annual Discount Rate Or The Semi Annual Ppt Download

25 2 Demand Supply And Equilibrium In The Money Market Principles Of Economics

Bond Prices Rates And Yields Fidelity

Understanding Bond Prices And Yields

:max_bytes(150000):strip_icc()/YieldCurve2-362f5c4053d34d7397fa925c602f1d15.png)

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

Comments

Post a Comment